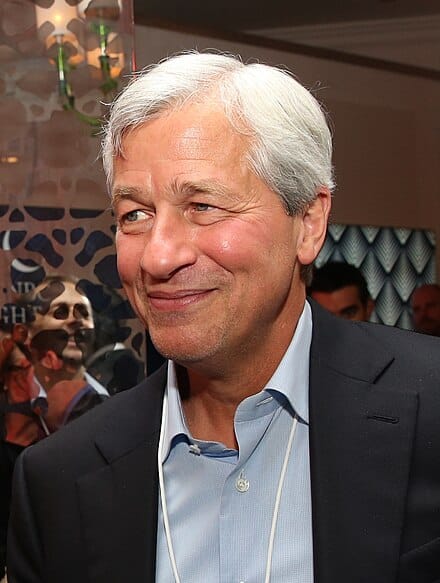

The Chairman and Chief Executive Officer of JP Morgan, Mr. Jamie Dimon, has advised countries, including Nigeria seeking Foreign Direct Investments(FDIs) to ensure consistency in their regulatory framework and policies.

Dimon who stated this on Wednesday at the 30th Nigerian Economic Summit(NES#30) in Abuja, said to attract investments requires consistent laws, regulations, rules, legislation, and legal environments, to woo foreign investors.

He noted that when these are in place, investors would be attracted because a lot of countries in the legal environment flip back and forth, and the government flips back and forth.

The JP Morgan Chairman revealed that JP Morgan would double or even triple its investment in the development banks in various countries across the world.

Delving into how to attract investment, Mr. Dimon said, “There’s no mystery about that; you know, capital goes to where it’s taken care of, where people think they can make some money and have a return on the capital in the long run.

“And very often countries, I’m not talking about Nigeria, if they have very inconsistent policies, they don’t want to go there, and the real capital is going to come from companies”.

He added that “I think we in America do a much better job than I call development finance.

“If you look at our development institutions, we could double, triple that, and I think we should, and as they grow.

“JP Morgan will double, triple our investment in the development banks, but the real capital is private capital companies around the world that might be sovereign wealth funds, and they want to come here for investment opportunity.

“So to do that, requires consistent laws, consistent regulations, consistent rules, consistent legislation, consistent legal environments, you will get plenty of capital here, but it’s got to be consistent, because a lot of countries in the legal environment flip back and forth, and the government flips back and forth.

“People are just afraid to make those investments, and our investment when we try to do it, at least, since I’ve been to JP, we’ve never left the country.

“Once we go we get better and smarter, and then we try to enhance what we do here. But those rules to get capital are pretty basic everywhere”.

JP Morgan, which has been operating in Nigeria since 1960 but opened a representative office in the country in 1982 noted that capital, investments, jobs, among others are good for a country, and if a company is not financially healthy, it will fall.

He pointed out that regulations do not inhibit companies from growing rather good leadership, which encapsulates trust, good administration is required to manage businesses effectively.