By Chidi Ugwu

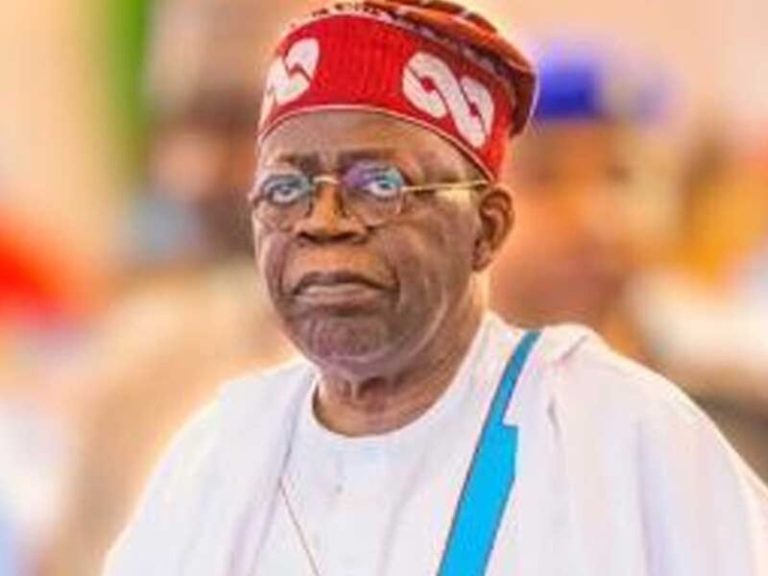

The Tinubu Media Support Group (TMSG) is confident that the sub-nationals would, this year, get far more than the N3.77 trillion allocated to states from Value Added Tax (VAT) collections in 2025 as a result of the strong commitment of the President Bola Tinubu administration to grassroots development.

According to the group, this is reflected in the administration’s decision to allocate five per cent of the federal government’s share of VAT receipts to states starting in 2026.

In a statement signed by its Chairman Emeka Nwankpa and Secretary Dapo Okubanjo, TMSG pointed out that this will automatically increase the allocation to states from the federation account.

The statement reads in part: “We are aware that data from the Federation Account Allocation Committee (FAAC) on VAT allocation to the three tiers of government for 2025 showed a 26.46% year-on year increase from the N6.11 trillion disbursed in 2024 to N7.73 trillion.

“And while it may be easy to attribute the increase to inflation, we are certain that improved compliance by businesses as a result of efficiency in revenue collection by the Federal Inland Revenue Service (FIRS) now known as the Nigerian Revenue Service (NRS) played a major role.

“Now with the tax reforms operational, especially as the federal government has conceded five per cent from its original 15% share to states, the allocation to the sub-nationals from VAT collections is bound to increase.

“For the avoidance of doubt, under the new tax laws, the federal government gets 10% of VAT collections, 55% goes to the states while the local government collects 35% as part of efforts to empower the sub-nationals to embark on developmental projects.

“We believe that the Tinubu administration deserves commendation not only for ensuring improved VAT collections but also for conceding 90% of all accruals from VAT to states and local governments.

“There is no reason why the sub-nationals would not get far more than they did in 2025 from VAT this year. We also believe that there is no reason why Nigerians, especially at the grassroots should not feel the benefit of improved allocations.”

TMSG added that it looks forward to governments at sub-national levels doing more than they are doing to complement the efforts of the Tinubu administration across all sectors of the economy.