Domestic productivity enabler, the Nigerian Content Development and Monitoring Board (NCDMB), has launched a new credit facility line for firms willing to collocate in its integrated petroleum equipment manufacturing hubs.

The $50 million fund would now swell the volume of cash intervention available for local players in the domestic petroleum industry to nearly $400 million when reinvestments of proceeds from maturing credits are factored in.

The facility and infrastructure havens termed Nigerian Oil and Gas Parks Scheme or NOGAPS are conceived by the board to ease domestic production of key industry equipment and facilities as potent strategy in significantly displacing the volume of materials imported for use in the local petroleum industry.

With some of the NOGAPS manufacturing hubs at commissioning stages and utility companies setting up supply lines to support activities in the parks, relocating manufacturing companies to the new sites comes with huge cash calls which the struggling local manufacturers might not easily secure from the conventional money market.

In its traditional full loop intervention plans, the NCDMB added new funding incentives in addition to congenial environment for all players taking position in the new parks.

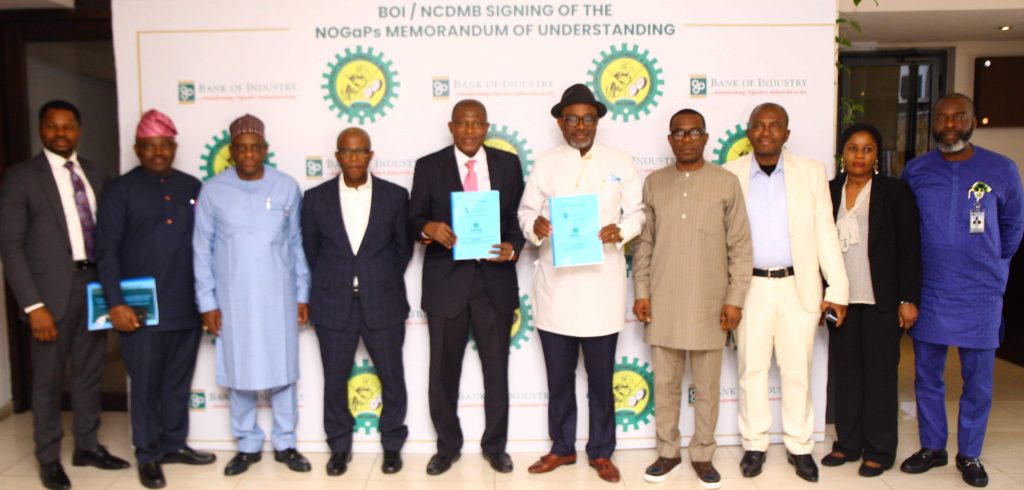

Under the new loan packages, the NCDMB enlisted the Bank of Industry also called BOI to launch a $50 million credit line specifically for companies taking the status of anchor investors in NOGAPS.

The board says the new fund would be a stand-alone product line with distinct fund allocation and special eligibility criteria and collateral structure.

At the official launching of the fund in Lagos, the Executive Secreta;ry of NCDMB, Engr Simbi Wabote, declared that “the fund will provide loans to Nigerian companies that meets the criteria to operate in any of the designated NOGAPS Industrial Park for the purpose of financing manufacturing activities, purchase of fixed assets, working capitals and logistic.”

He explained that the “beneficiaries will get a maximum single obligor of $3.0 million and minimum of single obligor of $250,000.00 with one year moratorium repayable within five years at five percent interest per annum.”

In hinting at benefits that await anchor investors in the parks which are located in Bayelsa and Cross River States, Engr Wabote pointed at single interest rate credit facility for manufacturers, low rate associated with long term space rents, steady power supply, full production facilities and infrastructure, and suspension of payments until production commencement.

According to Wabote, “the decision of the Board to establish the product was informed by the peculiarities of the manufacturing sector, which include infrastructure challenges, long gestation, long lead time before returns, low margins on products, and high risk attached to the endeavor, in addition to the reluctance of commercial banks to lend to the sector and application of stiff collateral and eligibility criteria where loans are extended.”

The fund is to incentivize companies that would operate in the Nigerian Oil and Gas Parks and engage in the manufacturing of equipment components used in the oil and gas industry and linkage sectors, he reiterated.

Engr. Wabote made it clear that the fund would only be accessed by companies that take up spaces in the park to procure equipment or build their manufacturing shopfloor within the park.

He pointed out that the NOGAPs Manufacturing Fund is different from the initial $300 million already managed by BOI to support Nigerian businesses that contribute one percent of their project budgets to the Nigerian Content Development Fund.

On the criteria for accessing the NOGAPS manufacturing funds, the Executive Secretary hinted that unlike that Nigerian Content Intervention Fund (NCIF) which requires companies to be contributors before they can benefit, the NOGAPS fund is open to all companies domiciled and producing within the parks.

Managing Director of Bank of Industry, Mr. Olukayode Pitan, noted that the fund would would be deployed and managed to achieve the set goal of promoting in-country manufacturing and creation of jobs.

Mr Pitan pointed out that the low interest rate is attractive and easy to pay back.

“The interest rates are very good just like the initial fund which is less than ten percent and the same thing will apply to this one. All we are looking for are Nigerians who want to manufacture in Nigeria,” he explained.

He charged Nigerian companies to harness the opportunity to pick up space within the park to produce locally.

It would be recalled that NCDMB established the NCI Fund in 2018 with the purpose of financing oil and gas companies to increase capacity and grow Nigerian Content in the industry.

Presently, the BOI manages five product lines of the NCI Fund. Manufacturing Finance is allocated $10 million; Asset Acquisition Finance has $10 million; Contract Finance is allocated $5 million; Loan Refinance holds $10 million; and Community Contractor Finance has N20 million.

The Board also engaged the Nigerian Export-Import (Nexim) Bank under a 2021 agreements to manage a $30 million Working Capital Fund for oil and gas service companies and separate $20 million Fund for Women in Oil and Gas Intervention Fund.

The Oracle Today reports that the credit lines are part of the strategies of the NCDMB to not just reduce the pressure from the petroleum industry on local banking system, boost survival rate of local companies, accelerate job creation and optimize the NCF; the credit lines also stand as viable income channels, making the board the only government agency in Nigeria supporting local businesses with own funds.

And to make the values sustainable, the board and BOI just signed a supplementary memorandum of understanding for the $300 million Nigerian Content Intervention Fund to be rolled over for the next batch of borrowers.