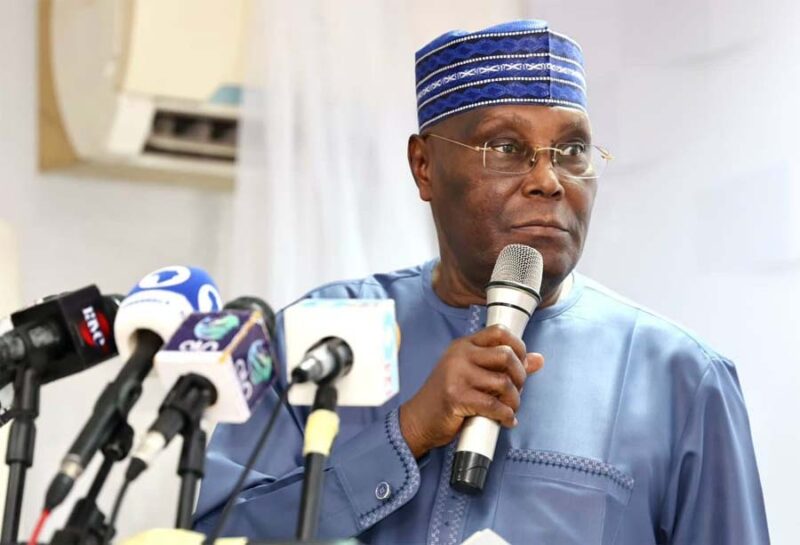

Former Vice-President of Nigeria Atiku Abubakar has condemned plans by the Federal Government to increase the value-added tax (VAT) from 7.5 per cent to 10 per cent as a punitive to businesses currently facing deterioration.

In a social media post on Sunday, Atiku described the move as a “regressive and punitive policy”.

“President Bola Tinubu, alongside his coterie of advisers, has resolved to raise the VAT rate from 7.5% to 10%, even as the NNPCL has announced a soaring PMS price increase at the pump,” he said.

“This move unveils a new era of regressive and punitive policies, and its impact is destined to deepen the domestic cost-of-living crisis and exacerbate Nigeria’s already fragile economic growth.

“President Tinubu and his entourage seem to be resorting to their familiar tactic: heaping burdens upon the impoverished while steadfastly ignoring their extravagant excesses!

“Tinubu’s actions reflect a profound insensitivity to the plight of the less fortunate as he indulges in the opulent renovation of villas and the acquisition of new jets and vehicles for himself and his family.

“One need not be an economist to grasp the ominous implications of President Tinubu’s ill-conceived policies for Nigeria’s future.”

He noted that the continued rise in taxes and interest rates had proved “excessively onerous, debilitating businesses of all sizes and leading to job losses while intensifying the suffering of the poor”.

Atiku also said the introduction of the policy “jeopardises job creation, wealth generation, and the sector’s long-term prosperity, casting a shadow over Nigeria’s sustainability and development”.

“President Tinubu and his advisers would be wise to redirect their efforts towards crafting sustainable solutions to the systemic shocks afflicting the economy rather than compounding the crisis with measures destined to ignite further turmoil,” he said.

The former vice-president said the manufacturing sector had endured “relentless strife since Tinubu’s ascendancy”, with its contribution to the gross domestic product (GDP) “diminishing by over 20% since December 2023, as reported by the NBS”.

Taiwo Oyedele, chairman of the presidential committee on fiscal policy and tax reforms, on May 8 said there was a need to increase the VAT rate.

He also said the committee had proposed adjusting the sharing formula for VAT.

According to section 40 of the VAT Act, the federal government gets 15 percent of the tax revenue, states share 50 percent, and local governments share the balance of 35 percent.